FWRA – Online Digital Risk Assessment Platform

Maintain your firm wide financial risk exposure with our online platform

Digital Firm Wide Financial Crime Risk Assessment

In partnership with LensIQ

We’re proud to be partnering with LensIQ to offer a market-leading Firm-Wide Risk Assessment (FWRA) platform designed specifically for regulated firms.

The platform is built for ease of use and regulatory alignment — helping MLROs, AML teams, and senior managers identify and evidence their key financial crime risks and controls in a streamlined, repeatable way.

Transforming Risk Management for Modern Businesses

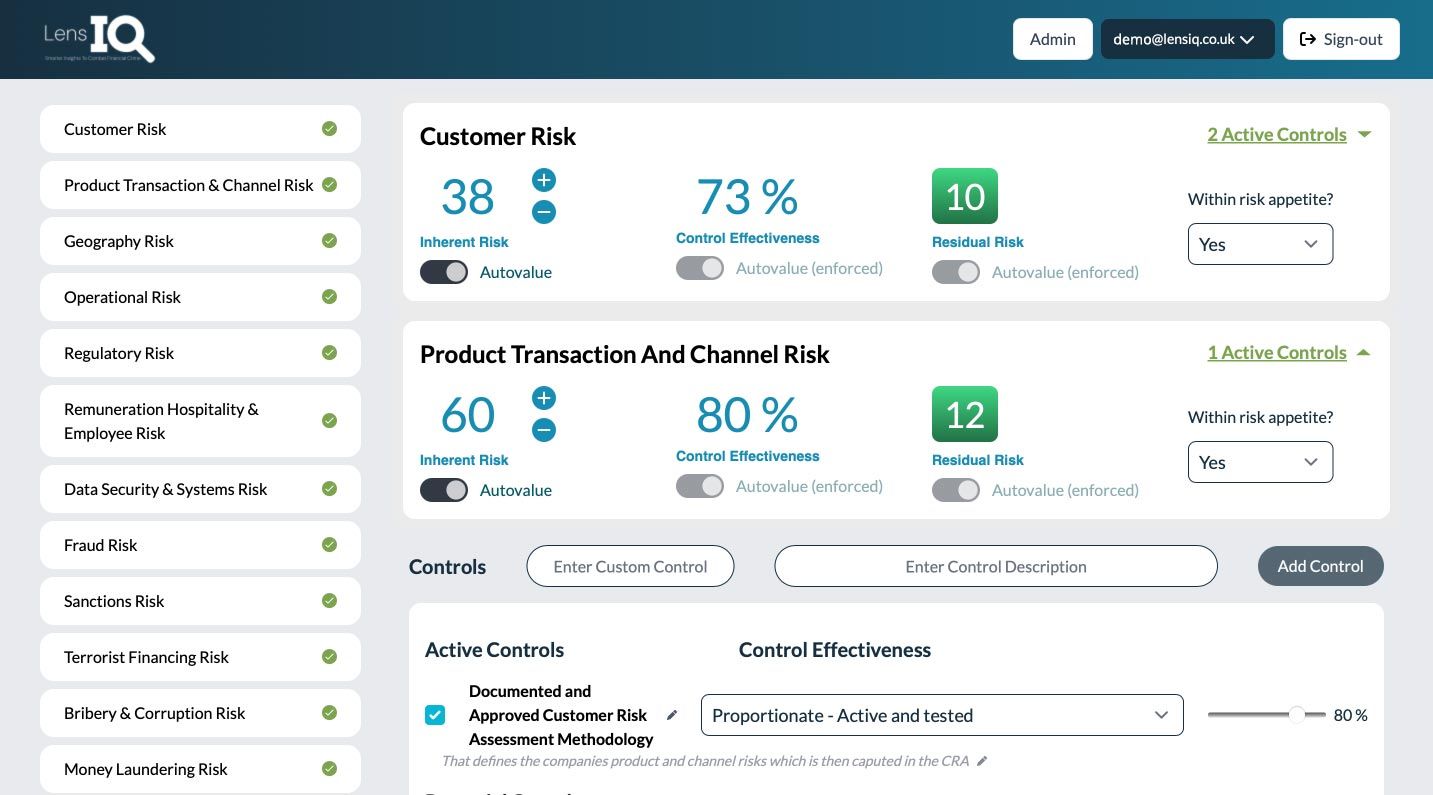

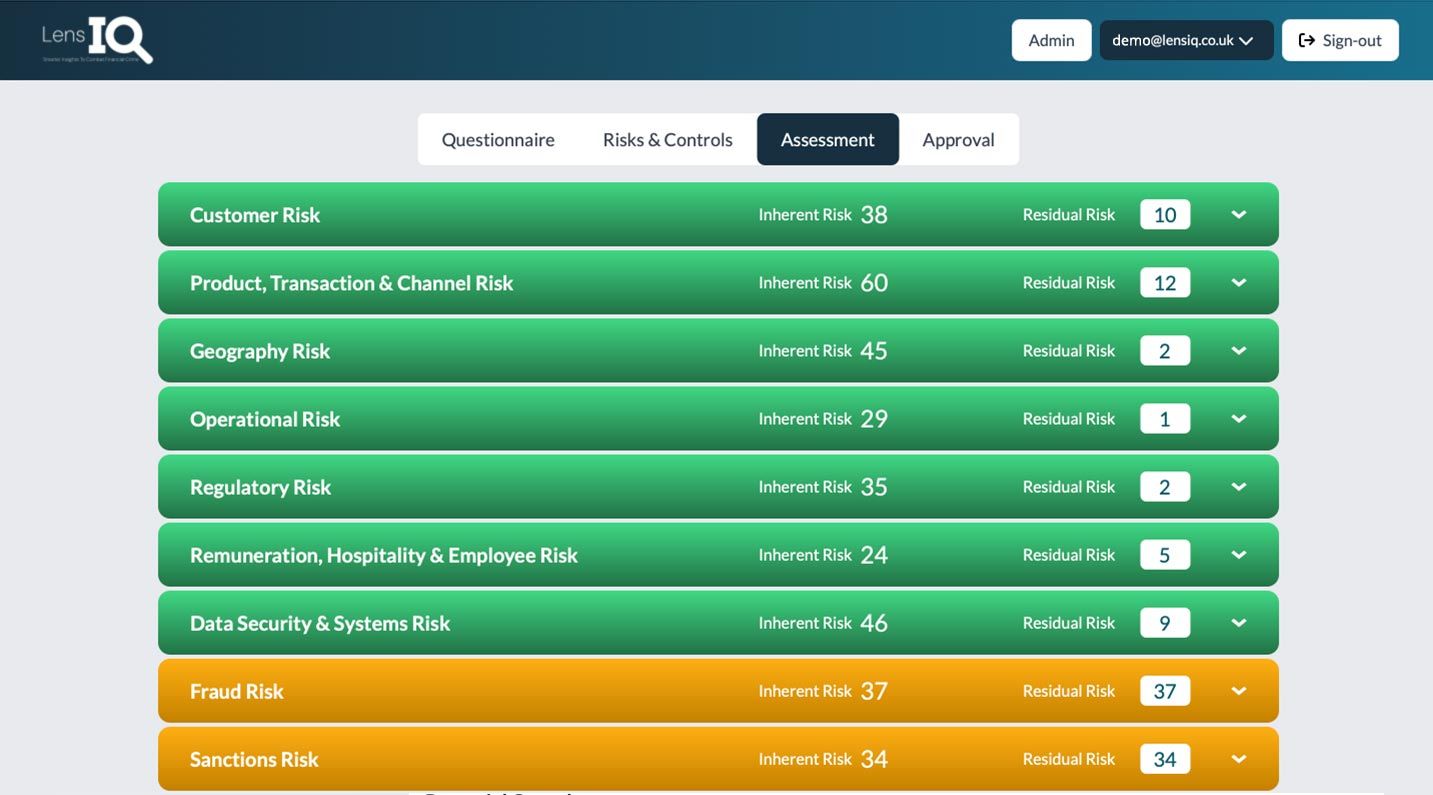

GCAL has chosen to collaborate with LensIQ because their platform redefines how financial crime risks are identified, assessed, and managed. Designed for forward-thinking businesses, this innovative solution replaces outdated spreadsheet methods with an intuitive, automated workflow platform.

It enables firms to assess AML and Financial Crime Risks not only at the inherent level but also at the residual level by incorporating custom controls that are evaluated for their effectiveness in mitigating inherent risks, providing a comprehensive residual risk score

Book a Free 14-Day Trial

Key Features That Set Us Apart

1. Always Dynamic, Never Static

Stay ahead of the curve with real-time updates. Our platform dynamically adapts to regulatory changes, sector risks, jurisdictional risk ratings, and internal control modifications – ensuring your risk assessments are always current and compliant.

2. Data-Driven Insights, Expert Methodology

3. Effortless Collaboration and Automation

4. Customisable to Fit Your Business

5. Regulatory Readiness at Your Fingertips

6. Comprehensive Risk Categories

Address all critical risk areas, including:

- Money Laundering

- Sanctions

- Fraud

- Bribery and Corruption

- Human Trafficking

- Proliferation Financing

- Terrorism Financing

- Tax Evasion

- Insider Trading

Why Choose LensIQ Digital Risk Assessment?

Efficiency:

Save time and resources with automated workflows and real-time updates.

Clarity:

Future-Ready:

Expertise-Driven:

How It Works

This interactive, digital platform is designed to make the Firm-Wide Risk Assessment process simple, consistent, and regulator-aligned.

Whether you’re updating your current FWRA or starting from scratch, LensIQ guides users through each key risk area using intelligent prompts, dropdown menus, and real-time feedback. The structured framework ensures all relevant areas are addressed, and the intuitive dashboard enables clear visibility, ongoing monitoring, and action planning.

Book a Free 14-Day Trial

We’re pleased to offer firms a no-obligation 14-day trial to explore the platform.

If you’d like to see how it works or discuss how it could support your compliance programme, get in touch and we’ll get you set up.