CERTIFIED ONLINE TRAINING

Managing the Risks of Terrorist Financing

Compliance Certificate

A programme that is designed to provide the knowledge and guidance required to be a senior counter-terrorist financing professional

Course Overview

The GCAL Advanced Certificate in Counter-Terrorist Financing (CTF) is a certified, instructor-led online programme designed for AML and Financial Crime professionals working in the regulated sector who want to ensure their firm has an effective control framework to identify and manage terrorist financing risks.

Expanding on core AML training, this unique course takes a focused, in-depth look at the specific challenges of counter-terrorist financing, equipping learners with the tools to assess, escalate, and mitigate CTF risks across firm-wide and client-level operations.

Delivered by financial crime experts and MLROs, the course combines expert-led instruction with real-world case studies, interactive learning, and practical frameworks. Learners will explore the latest terrorist financing typologies, designated individuals and groups, and emerging methodologies used to move funds and exploit financial systems.

The programme provides detailed insight into relevant UK, EU, and US legal obligations, international regulatory expectations, and integrate CTF into your firm’s AML & Financial Crime risk assessment, governance, and reporting processes.

This certified, CTF programme is designed to build on your existing AML knowledge—bridging the gap between regulatory theory and frontline application. By the end of the programme, you’ll be equipped to identify red flags, understand escalation and internal reporting requirements, and proactively respond to terrorist financing threats in a regulated environment.

Upon successful completion, learners receive the GCAL Advanced Counter-Terrorist Financing Certificate and earn the GC(AdvCTF) professional designation—signifying globally recognised expertise in this high-risk area of financial crime compliance. A verifiable digital badge is also awarded, making it easy to showcase your achievement on LinkedIn and share with employers, regulators, and peers.

DESIGNATION

Awarded in association with

Advanced AML Course Package

Course Details

Learning Outcomes

By the end of this AML Certified programme, learners will be able to:

- Define key terms and regulatory classifications related to terrorist financing, including designated individuals, organisations, and legal obligations under UK, EU, US, and international frameworks.

- Identify and assess how terrorist financing occurs, including traditional methods, emerging typologies, and real-world case examples.

- Apply red flag indicators and GCAL Red Cards to detect suspicious activity and escalate appropriately within a regulated environment.

- Incorporate terrorist financing risks into firm-wide and client-level risk assessments, aligning with AML frameworks and regulatory expectations.

- Understand internal and external reporting obligations, including SAR submission, documentation standards, and regulator expectations.

- Demonstrate certified expertise in CTF compliance, earning the GC(AdvCTF) designation and a verifiable digital badge to showcase on LinkedIn and to employers.

Who Should Attend

This certified counter-terrorist financing (CTF) and AML programme is ideal for professionals looking to build advanced expertise in counter-terrorist financing risk management and take a proactive role in protecting their firm against terrorism-related threats, including:

- MLROs and Deputy MLROs accountable for their organisation firm-wide AML/CTF control frameworks.

- Heads of Financial Crime Compliance (FCC) seeking to enhance their firm’s CTF control and screening frameworks, and integration of terrorism risk into broader financial crime frameworks.

- Internal Auditors, Investigators, and Assurance Professionals assessing the effectiveness of CTF controls, red flag response mechanisms, and regulatory reporting procedures

- Aspiring FCC and AML leaders preparing for advanced responsibilities in CTF, screening, and financial crime compliance

This programme supports AML and FCC professionals seeking to strengthen their practical understanding of terrorist financing typologies, enhance internal detection and reporting procedures, and align with evolving UK, EU, US, and international CTF regulatory requirements.

Delivery Format

All GCAL certified programmes are delivered online via an on-demand, instructor-led video format, with the flexibility to study at your own pace.

- Hosted via GCAL’s digital learning platform

- Interactive elements, including real-world case studies and scenario-based learning

- Clear learning journey with access to support materials, reading lists, and guided exercises

- Final assessment includes a 20-question multiple-choice exam

- Duration – 7–10 hours of learning time

Course Modules

This advanced-level certificate programme is structured around key areas essential to understanding, detecting, and managing terrorist financing risks. Each module combines regulatory insight, case-based learning, and practical application. Key modules include:

- Introduction, Definitions and Lexicon Build a strong foundation in CTF by exploring key terms and definitions used in counter-terrorist financing. Understand the language used by regulators, law enforcement, and international bodies when referring to terrorist financing and related risks.

- What is a Terrorist, Terrorist Organisation, and Terrorist Financing? Examine how terrorists and terrorist groups are defined under UK, EU, US, and international law. Understand what constitutes terrorist financing and explore how individuals and groups are designated under sanctions and watchlists.

- UK and International Regulation and Explore the legal and regulatory frameworks governing terrorist financing, including obligations under the UK Money Laundering Regulations, FATF recommendations, EU directives, and US Patriot Act provisions. Learn what’s expected of regulated firms in terms of detection, reporting, and prevention.

- Summary of the Evolution of Terrorist Financing Gain historical and contextual insight into how terrorist financing has evolved over time—from state-sponsored activities to decentralised, self-funded networks. Understand how shifting geopolitical and technological factors have influenced risk exposure.

- How Terrorist Financing Occurs Dive into the methods and typologies used to fund terrorism. Learn how legitimate businesses, charitable fronts, informal value transfer systems, and digital currencies are exploited for terrorist purposes. Case studies illustrate how financial flows are concealed and laundered.

- Red Flags Identify key indicators of potential terrorist financing. Learn how to apply red flags in practice, what frontline staff should look for, and how these indicators support internal escalation and external reporting. Explore how behavioural, transactional, and geographic risk factors intersect. As part of this module, learners will gain access to GCAL’s Red Cards—a structured set of facts, indicators, and risk triggers that, when combined, increase the probability of a positive identification of terrorist financing activity.

- Management of Expectation, Reporting & Risk Assessment Understand your firm’s regulatory expectations around terrorist financing—what regulators, law enforcement, and auditors expect you to have in place. Learn how to incorporate terrorist financing into your firm-wide and client-level risk assessments, and how to manage internal escalation, external reporting (e.g., SARs), and audit preparation.

Assessment

- Number of Questions: 20

- Question Format: Multiple Choice

- Pass Mark: 70%

Your result will appear immediately upon submitting your answers. If you meet the pass mark, a digital badge and e-certificate will be issued instantly via the GCAL LMS. You’ll also receive a secure link to share your certification on LinkedIn, with your employer, or across your professional network.

See our Assessment Terms & Conditions for more information.

Certification

Learners who successfully complete the course and assessment will receive:

- • GCAL Advanced Terrorism Financing Certificate

- The post-nominal designation GC(AdvCTF)

- A digital badge – shareable and verifiable via LinkedIn and other professional platforms

Pricing Options

We offer flexible pricing based on your professional development goals and the scale of your learning journey:

ENROLMENT

£800

Perfect for professionals looking to complete this certified programme and earn the GC(AdvCTF) designation.

Managing the Risks of Terrorist Financing Compliance Certificate

ADVANCED COURSES

£700 PER COURSE

If you’re planning to enrol in more than one GCAL Advanced Programme, enjoy a discounted rate when purchased together. Ideal for professionals building a broader skill set across AML, sanctions, fraud, and governance.

Browse All CoursesCOURSE PACKAGE

£3,000

Access all six GCAL Advanced Financial Crime Compliance programmes at a special bundle rate. Perfect for individuals or teams seeking comprehensive, cross-cutting training across key AML AND financial crime risk areas.

More InformationAll prices shown exclude VAT which will be added at checkout if applicable

LICENCES

Designed for organisations looking to roll out certified financial crime compliance training at scale. Packages include group enrolment, learner progress tracking, completion reporting, and dedicated admin support.

Contact us to discuss your enterprise training needs.

info@greatchatwellacademy.comContact FormReady to Enrol?

✔ Advance your AML and Financial Crime Compliance career

✔ Build leadership-level knowledge

✔ Join a trusted community of Financial Crime Compliance professionals

Buy Now or contact us at info@greatchatwellacademy.com to request an invoice or discuss group access.

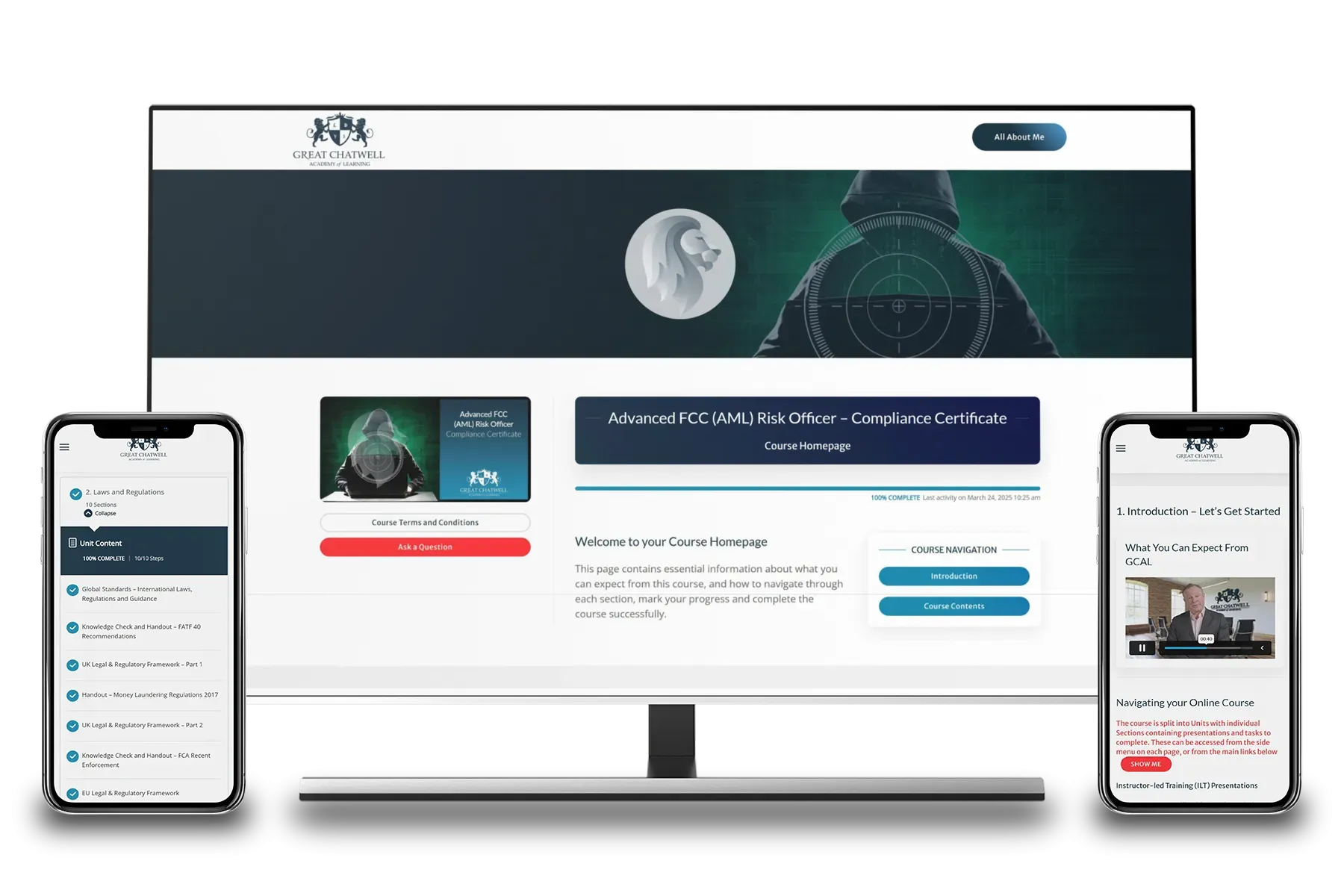

The GCAL LMS

Your Learning Management System

Experience the flexibility of on-demand AML and financial crime compliance training with our user-friendly GCAL Learning Management System (LMS). Designed for busy AML and Financial Crime compliance professionals, our platform allows you to access expert-instructor led courses and essential materials anytime, anywhere — on desktop, tablet, or mobile.

Auto-save functionality ensures your progress is always securely stored, so you can pick up right where you left off. With real-time progress tracking, empowering you to monitor your learning and stay engaged as you build the advanced skills needed to manage financial crime risk in a fast-changing regulatory landscape.