CERTIFIED ONLINE TRAINING

Financial Crime Risk Assessment

Compliance Certificate

A programme that is designed to provide the knowledge and guidance required to be a senior financial crime risk assessment professional

Course Overview

Firms across all regulated sectors continue to struggle with producing effective Firm-Wide Financial Crime Risk Assessments (FCRAs)—also referred to as BWRAs, FWRAs, or AML Risk Assessments. Many fall short in key areas such as evidencing inherent and residual risk, articulating control effectiveness, and aligning assessments to their business models. The GCAL Advanced FCRA Compliance Certificate directly addresses these common failings, equipping professionals with the applied skills and regulatory context needed to build and maintain robust FCRA frameworks.

This interactive, instructor-led, AML certified programme offers a structured, practical approach to AML and financial crime compliance, covering all critical areas of risk assessment. Drawing from real-world enforcement cases and industry challenges highlighted in recent regulatory feedback, the course introduces learners to the GCAL Risk Assessment Model — a tested framework designed to help firms move beyond generic templates and develop tailored, dynamic assessments that meet the expectations of both UK and international regulators.

The course explores:

- How to properly identify and assess both inherent and residual financial crime risks

- The importance of control effectiveness and how to evidence it

- Developing methodologies that are defensible and proportionate

- Methods to address regulatory gaps and weaknesses in current FCRAs

- How to improve Board-level reporting and assurance using risk data

- “Thinking like a criminal” to enhance typology awareness and risk identification

Through interactive exercises, real-life case studies, and guided model walkthroughs, learners will gain the confidence and competence to design, implement, and evidence a risk assessment that stands up to regulatory scrutiny—moving beyond tick-box compliance.

Upon successful completion, participants are awarded the GCAL Financial Crime Risk Assessment Compliance Certificate and earn the professional designation GC(FCRA). A verifiable digital badge is also issued, showcasing certified capability in AML and financial crime compliance to peers, employers, and regulators.

DESIGNATION

Awarded in association with

Advanced AML Course Package

Course Details

Learning Outcomes

By the end of this AML Certified programme, learners will be able to:

- Design and implement a comprehensive firm-wide financial crime risk assessment (FCRA) aligned with UK and international regulatory expectations.

- Identify and assess key financial crime risk factors, including products, delivery channels, geographies, customer types, sectors, transactions, third-party relationships, and outsourcing arrangements—ensuring full-spectrum risk visibility.

- Differentiate between inherent and residual risks, apply structured methodologies, and evaluate the effectiveness of financial crime controls to inform overall risk ratings.

- Identify and map relevant financial crime types—including money laundering, terrorist financing, sanctions evasion, fraud, bribery, tax crimes, and more—ensuring risk coverage reflects the firm’s business activities and regulatory exposure.

- Detect and address weaknesses in existing risk assessment frameworks, including gaps in methodology, documentation, and alignment with regulatory expectations.

- Produce audit-ready, regulator-facing documentation that clearly evidences risk ratings, control effectiveness, and rationale, supporting strong internal governance and external assurance.

- Enhance typology awareness and analytical capability through thinking like a criminal, enabling better risk detection, data-led MI reporting, and effective communication at Board level

Who Should Attend

This AML certified programme is ideal for professionals looking to deepen their expertise and take a leading role in AML and Financial Crime Risk Assessments, including:

- MLROs and Deputy MLROs responsible for firm-wide financial crime risk assessments and AML frameworks

- Heads of Financial Crime Compliance (FCC) seeking to enhance risk assessment methodologies, AML governance, and regulatory alignment

- Senior Financial Crime or AML professionals managing AML, CTF, sanctions, fraud, and broader financial crime risks across the business or involved in the completion of a Financial Crime Risk Assessment

- Internal Auditors and Assurance Professionals evaluating the design, implementation, and effectiveness of financial crime risk assessment models and controls

- Aspiring AML or FCC leaders preparing for senior roles such as MLRO, Deputy MLRO, or Head of Financial Crime Risk and Compliance

This programme supports AML professionals seeking to build confidence and capability in designing, implementing, and completing financial crime risk assessments in line with evolving UK and international regulatory expectations

Delivery Format

All GCAL certified programmes are delivered online via an on-demand, instructor-led video format, with the flexibility to study at your own pace.

- Hosted via GCAL’s digital learning platform

- Interactive elements, including real-world case studies and scenario-based learning

- Clear learning journey with access to support materials, reading lists, and guided exercises

- Final assessment includes a 20-question multiple-choice exam

- Duration – 7–10 hours of learning time

Course Modules

This advanced-level certificate is structured around core themes essential to building, leading, and sustaining a robust AML and financial crime compliance programme. Key modules include:

- Introductions and Defining the Risk: This opening module sets the foundation by introducing the core principles of financial crime risk assessment. Learners will explore the purpose and scope of an FCRA, define key terminology, and understand the distinction between inherent and residual risk. This module also establishes the importance of a proportionate, risk-based approach.

- Identifying the Risk – “Think Like a Criminal”: This session explores practical strategies for identifying financial crime risks through the lens of a criminal mindset. Learners are introduced to real-world typologies across money laundering, fraud, terrorist financing, sanctions evasion, and other predicate offences. The focus is on anticipating criminal behaviour, to understand the risks your firm faces

- UK and International Legal and Regulatory Responsibilities: A deep dive into the legal and regulatory frameworks shaping the FCRA process. This module covers the expectations of UK regulators such as the FCA and PRA, as well as international bodies including FATF and the EU. Learners will examine enforcement trends and guidance, gaining clarity on what regulators expect from a robust FCRA.

- Managing the Risks – Performing a Risk Assessment: Here, learners develop practical skills to conduct an effective firm-wide financial crime risk assessment. This includes assessing inherent risk across key factors—products, delivery channels, geographies, customer types, transactions, third parties, and outsourcing—and applying methodologies to evaluate residual risk.

- Designing an FCRA and Risk Assessment Models: This module introduces the GCAL Risk Assessment Model, guiding learners in designing a tailored, evidence-based FCRA that aligns with the firm’s business model. The session includes walkthroughs of model structures, risk scoring, and documentation techniques to ensure auditability and regulatory defensibility.

- Risks & Controls – Further Design Considerations: Learners will explore the relationship between identified risks and control frameworks, including how to assess control effectiveness and map it to overall risk ratings. This module also addresses common weaknesses in control documentation and the importance of building a defensible methodology that withstands regulatory scrutiny.

- Managing the FCRA and Reporting the Risks: This practical module focuses on the ongoing management of the FCRA, including how to update, review, and integrate it into broader governance structures. Learners will understand the lifecycle of an FCRA and how it fits into risk management and compliance planning.

- Validation & Assurance of the FCRA:Assurance and validation are essential for FCRA credibility. This module provides tools and techniques to conduct independent validation and internal assurance, ensuring the assessment is not only accurate but defensible and regulator-ready.

- Communication, Management and Recording The final module focuses on effective communication and governance. Learners will explore how to present FCRA findings to senior management and Boards, build meaningful MI, and document the FCRA in a way that supports compliance, transparency, and accountability.

Assessment

- Number of Questions: 20

- Question Format: Multiple Choice

- Pass Mark: 70%

Your result will appear immediately upon submitting your answers. If you meet the pass mark, a digital badge and e-certificate will be issued instantly via the GCAL LMS. You’ll also receive a secure link to share your certification on LinkedIn, with your employer, or across your professional network.

See our Assessment Terms & Conditions for more information.

Certification

Learners who successfully complete the course and assessment will receive:

- • GCAL Advanced Financial Crime Risk Assessment Compliance Certificate

- The post-nominal designation GC(AdvFCR)

- A digital badge – shareable and verifiable via LinkedIn and other professional platforms

Pricing Options

We offer flexible pricing based on your professional development goals and the scale of your learning journey:

ENROLMENT

£800

Perfect for professionals looking to complete this certified programme and earn the GC(AdvFCR) designation.

Financial Crime Risk Assessment Compliance Certificate

ADVANCED COURSES

£700 PER COURSE

If you’re planning to enrol in more than one GCAL Advanced Programme, enjoy a discounted rate when purchased together. Ideal for professionals building a broader skill set across AML, sanctions, fraud, and governance.

Browse All CoursesCOURSE PACKAGE

£3,000

Access all six GCAL Advanced Financial Crime Compliance programmes at a special bundle rate. Perfect for individuals or teams seeking comprehensive, cross-cutting training across key AML AND financial crime risk areas.

More InformationAll prices shown exclude VAT which will be added at checkout if applicable

LICENCES

Designed for organisations looking to roll out certified financial crime compliance training at scale. Packages include group enrolment, learner progress tracking, completion reporting, and dedicated admin support.

Contact us to discuss your enterprise training needs.

info@greatchatwellacademy.comContact FormReady to Enrol?

✔ Advance your AML and Financial Crime Compliance career

✔ Build leadership-level knowledge

✔ Join a trusted community of Financial Crime Compliance professionals

Buy Now or contact us at info@greatchatwellacademy.com to request an invoice or discuss group access.

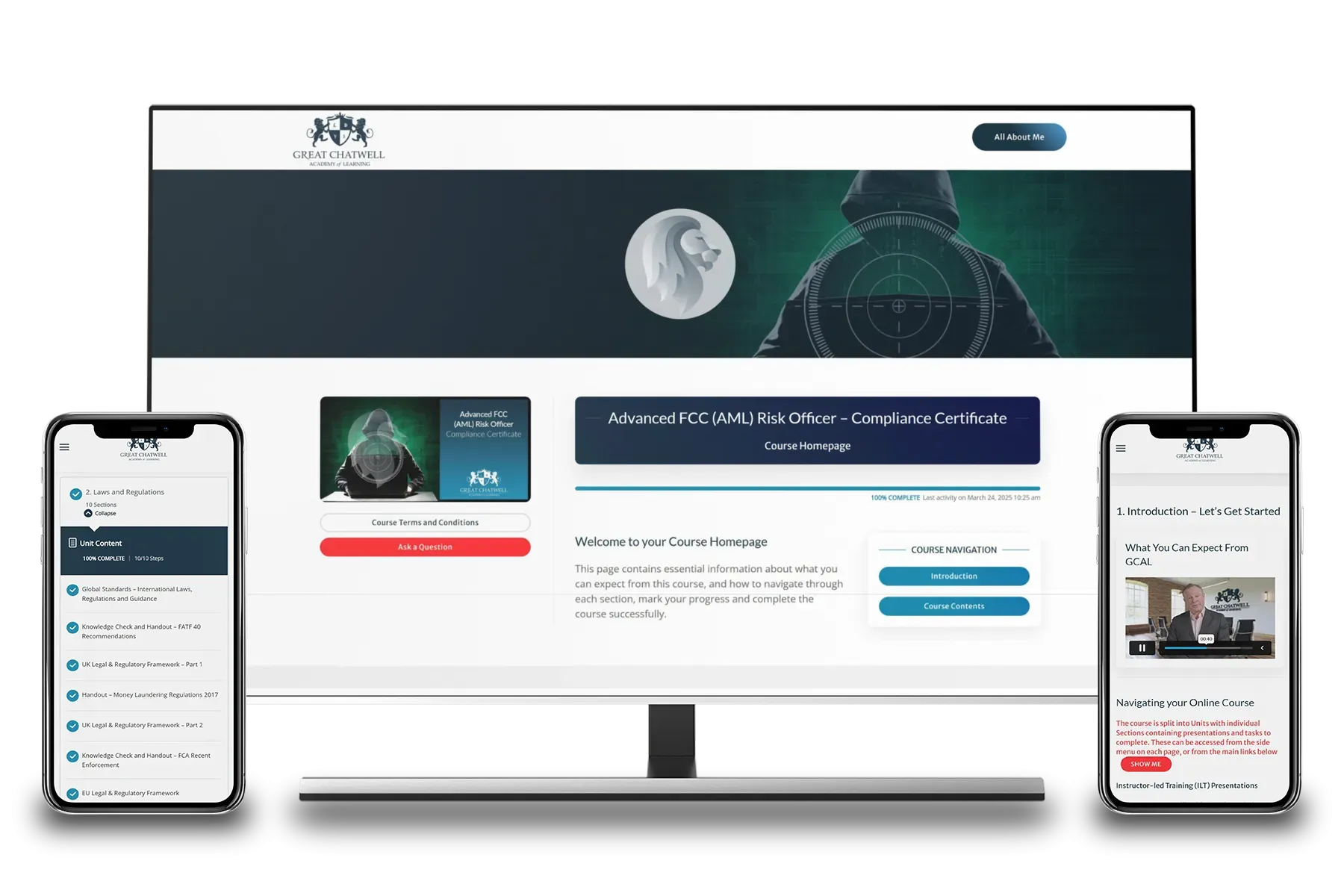

The GCAL LMS

Your Learning Management System

Experience the flexibility of on-demand AML and financial crime compliance training with our user-friendly GCAL Learning Management System (LMS). Designed for busy AML and Financial Crime compliance professionals, our platform allows you to access expert-instructor led courses and essential materials anytime, anywhere — on desktop, tablet, or mobile.

Auto-save functionality ensures your progress is always securely stored, so you can pick up right where you left off. With real-time progress tracking, empowering you to monitor your learning and stay engaged as you build the advanced skills needed to manage financial crime risk in a fast-changing regulatory landscape.