CERTIFIED ONLINE TRAINING

Customer Risk and CDD

Compliance Certificate

A programme that is designed to provide the knowledge and guidance required to be a senior customer risk and CDD professional

Course Overview

The GCAL Advanced Certificate in Customer Risk & CDD Compliance is an AML-certified, on-demand, instructor-led programme designed for financial crime and compliance professionals responsible for conducting Customer Due Diligence (CDD), Enhanced Due Diligence (EDD), and risk-based investigations in line with evolving UK and international regulatory requirements.

Through expert-led modules, this advanced certificate equips learners with the practical skills and tools needed to apply a Risk-Based Approach (RBA) to CDD. The course explores digital identity verification, beneficial ownership disclosure, and techniques to identify, assess, and manage customer risk—particularly in higher-risk relationships.

Learners will gain in-depth knowledge of key legal frameworks, including the UK Economic Crime and Corporate Transparency Act 2023, the Money Laundering Regulations 2017 (as amended), the FATF 40 Recommendations, and the FCA SYSC Handbook. The programme also introduces advanced investigative techniques, such as the use of Open-Source Intelligence (OSINT) to support EDD and internal investigations.

Real-world case studies guide learners through the identification and management of high-risk activities, including fraudulent identity and documentation, shell companies, complex layering, informal nominees, and money mulling. Learners will also explore how criminals bypass controls, and how to respond using effective countermeasures and escalation procedures.

This certified programme is ideal for AML and financial crime compliance professionals performing CDD and EDD checks, onboarding high-risk customers, or managing ongoing client relationships. It supports confident compliance with regulatory expectations and strengthens the organisation’s frontline defence against financial crime.

Upon successful completion, learners are awarded the GCAL Advanced Certificate in Customer Risk & CDD Compliance and earn the professional designation GC(AdvCDD)—a globally recognised credential demonstrating advanced expertise in customer risk assessment and due diligence practices. A verifiable digital badge is also awarded, making it easy to showcase your achievement on LinkedIn and share with employers, regulators, and peers.

DESIGNATION

Awarded in association with

Advanced AML Course Package

Course Details

Learning Outcomes

By the end of this AML Certified programme, learners will be able to:

- Describe current and emerging techniques used by criminals to obscure their identity, beneficial ownership, and control over the proceeds of crime—including the misuse of legal structures, shell companies, nominees, and layering techniques.

- Explain key UK and international legal and regulatory requirements governing customer due diligence, including the Money Laundering Regulations 2017 (as amended), FATF’s 40 Recommendations, and the UK Economic Crime and Corporate Transparency Act 2023.

- Define and apply the risk-based approach (RBA) to customer due diligence (CDD), including the use of simplified, standard, and enhanced due diligence (EDD) measures across different risk profiles.

- Identify and use authoritative sources of guidance and open-source intelligence (OSINT) to inform customer risk assessments, including Companies House, global PEP and sanctions lists, and adverse media search tools.

- Demonstrate how to conduct digital searches using search operators to verify customer identity and identify adverse media, inconsistencies, or reputational risks associated with higher-risk individuals and legal entities.

- Perform effective enhanced due diligence (EDD) for higher-risk customers and relationships, identifying red flags, recognising unusual activity, and supporting decision-making around onboarding, monitoring, or escalation.

Who Should Attend

This certified CDD and customer risk assessment programme is ideal for professionals responsible for conducting due diligence and managing financial crime risks throughout the customer lifecycle, including:

- MLROs and Deputy MLROs overseeing firm-wide customer onboarding, risk classification, and enhanced due diligence processes

- CDD Analysts, Onboarding Teams, and KYC Specialists involved in verifying identity, gathering documentation, and assessing client risk at onboarding and throughout the relationship

- Financial Crime Compliance Managers and Officers implementing and reviewing customer risk frameworks, and aligning with UK and international AML/CTF obligations

- Relationship Managers in front-line roles managing higher-risk client relationships and accountable for identifying and escalating suspicious behaviour

- Internal Auditors and Assurance Professionals assessing the effectiveness of customer due diligence controls and ensuring adherence to legal and regulatory expectations

- Aspiring Financial Crime and AML Professionals preparing for senior roles in onboarding, CDD/EDD, or customer risk oversight functions

Delivery Format

All GCAL certified programmes are delivered online via an on-demand, instructor-led video format, with the flexibility to study at your own pace.

- Hosted via GCAL’s digital learning platform

- Interactive elements, including real-world case studies and scenario-based learning

- Clear learning journey with access to support materials, reading lists, and guided exercises

- Final assessment includes a 20-question multiple-choice exam

- Duration – 7 hours of learning time

Course Modules

This advanced, AML certified programme is structured into the following modules, combining regulatory foundations, investigative techniques, and governance best practice. Each module builds on the last to help learners implement a robust, risk-based approach to customer due diligence (CDD) and enhanced due diligence (EDD). Key modules include:

- Legal and Regulatory Frameworks: UK and International Standards

Understand the core regulations that shape CDD and customer risk assessments, including the Money Laundering Regulations 2017 (as amended), FATF 40 Recommendations, FCA SYSC Handbook, and the UK Economic Crime and Corporate Transparency Act 2023. Explore global expectations and how to translate them into firm-level policies and controls. - Identity Verification and Beneficial OwnershipLearn how to verify identity for natural persons, legal entities, and legal arrangements, using both traditional and digital identity methods—including IP address analysis, biometric checks, and liveness detection. Understand how to assess Source of Funds (SOF), Source of Wealth (SOW), and Source of Income (SOI) and verify beneficial ownership via public registries like Companies House.

- Applying the Risk-Based Approach (RBA)Define and apply a risk-based approach (RBA) to CDD. Learn how to assess customers using the five risk factors outlined in regulation and differentiate between simplified, standard, and enhanced due diligence (EDD) profiles. Understand the rationale for risk categorisation and how it impacts onboarding, monitoring, and periodic reviews.

- Governance and Oversight: Six Pillars of Good CDD PracticeExplore GCAL’s Six Pillars of Good Governance model, including senior management engagement, internal procedures, record keeping, quality assurance, monitoring, and escalation. Learn how to embed these pillars into your compliance framework to support regulatory alignment and operational integrity.

- Identifying High-Risk Activity and Red FlagsRecognise and investigate high-risk customer behaviours and structures, including fraudulent ID documents, shell and shelf companies, complex layering, money mulling, and formal/informal nominees (e.g., TCSPs, friends or family). Learn how criminals bypass controls and how to identify risk early using red flag indicators.

- Investigating with OSINT and Adverse Media ToolsGain hands-on skills in using open-source intelligence (OSINT) and publicly available databases to verify identity, detect hidden risks, and enhance EDD reviews. Learn how to apply search operators and adverse media tools to identify reputational, legal, or financial risks associated with higher-risk customers.

- Reporting, Disclosure, and Case Study ApplicationKnow when and how to escalate unusual activity through internal channels or report to the National Crime Agency (NCA). Understand authorised disclosures, the DAML process, and how to mitigate risks related to tipping off, prejudicing an investigation, and constructive trusteeship. Complete the module with case study analysis, applying your learning to real-world scenarios involving disclosure, risk assessment, and escalation decisions.

Assessment

- Number of Questions: 20

- Question Format: Multiple Choice

- Pass Mark: 70%

Your result will appear immediately upon submitting your answers. If you meet the pass mark, a digital badge and e-certificate will be issued instantly via the GCAL LMS. You’ll also receive a secure link to share your certification on LinkedIn, with your employer, or across your professional network.

See our Assessment Terms & Conditions for more information.

Certification

Learners who successfully complete the course and assessment will receive:

- GCAL Advanced Suspicious Activity Reporting Compliance Certificate

- The post-nominal designation GC(AdvCDD)

- A digital badge – shareable and verifiable via LinkedIn and other professional platforms

Pricing Options

We offer flexible pricing based on your professional development goals and the scale of your learning journey:

ENROLMENT

£800

Perfect for professionals looking to complete this certified programme and earn the GC(AdvMLRO) designation.

Customer Risk & CDD Compliance Certificate

ADVANCED COURSES

£700 PER COURSE

If you’re planning to enrol in more than one GCAL Advanced Programme, enjoy a discounted rate when purchased together. Ideal for professionals building a broader skill set across AML, sanctions, fraud, and governance.

Browse All CoursesCOURSE PACKAGE

£3,000

Access all six GCAL Advanced Financial Crime Compliance programmes at a special bundle rate. Perfect for individuals or teams seeking comprehensive, cross-cutting training across key AML AND financial crime risk areas.

More InformationAll prices shown exclude VAT which will be added at checkout if applicable

LICENCES

Designed for organisations looking to roll out certified financial crime compliance training at scale. Packages include group enrolment, learner progress tracking, completion reporting, and dedicated admin support.

Contact us to discuss your enterprise training needs.

info@greatchatwellacademy.comContact FormReady to Enrol?

✔ Advance your AML and Financial Crime Compliance career

✔ Build leadership-level knowledge

✔ Join a trusted community of Financial Crime Compliance professionals

Buy Now or contact us at info@greatchatwellacademy.com to request an invoice or discuss group access.

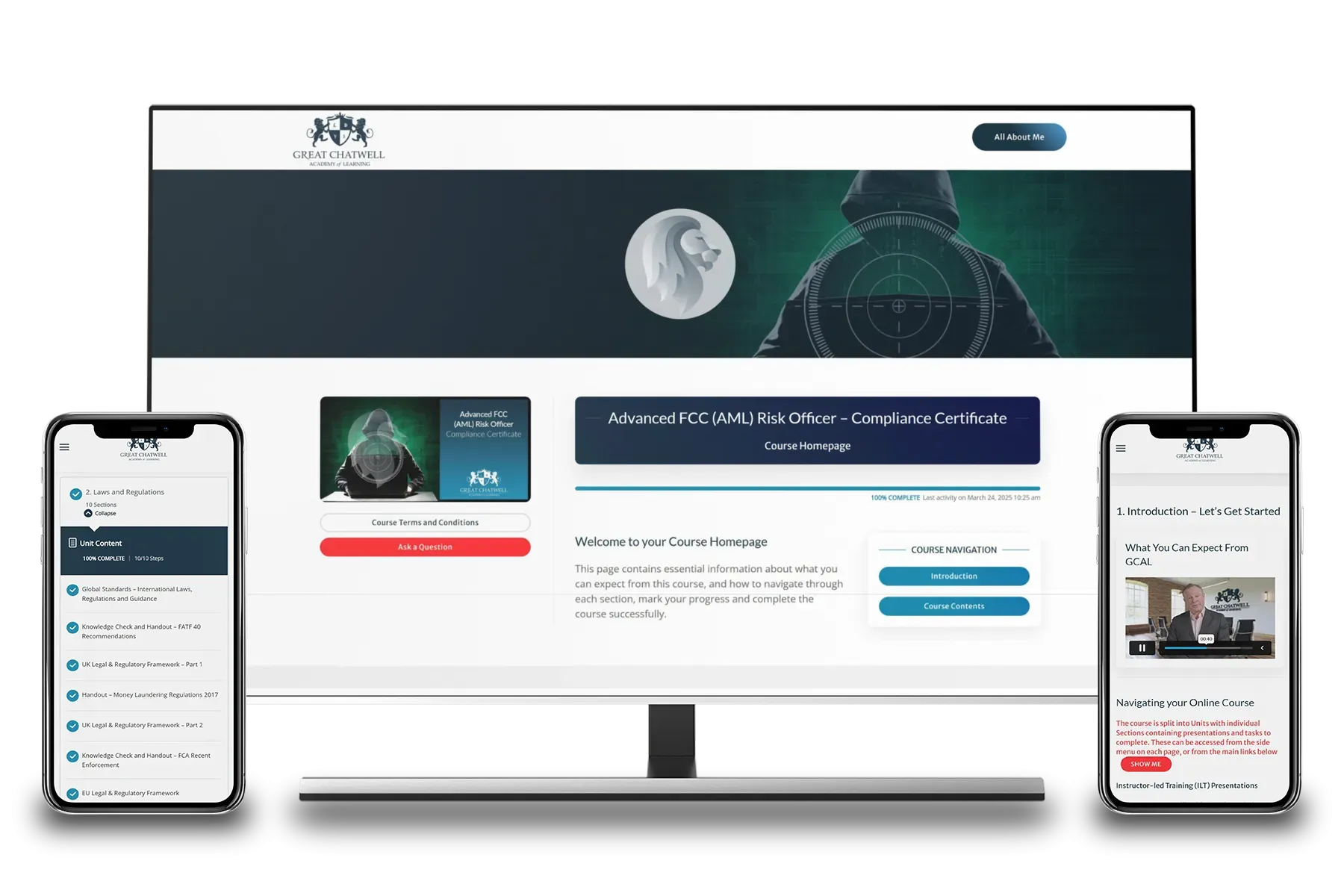

The GCAL LMS

Your Learning Management System

Experience the flexibility of on-demand AML and financial crime compliance training with our user-friendly GCAL Learning Management System (LMS). Designed for busy AML and Financial Crime compliance professionals, our platform allows you to access expert-instructor led courses and essential materials anytime, anywhere — on desktop, tablet, or mobile.

Auto-save functionality ensures your progress is always securely stored, so you can pick up right where you left off. With real-time progress tracking, empowering you to monitor your learning and stay engaged as you build the advanced skills needed to manage financial crime risk in a fast-changing regulatory landscape.