CERTIFIED ONLINE TRAINING

Advanced FCC AML Risk Officer

Compliance Certificate

A programme that is designed to provide the knowledge and guidance required to be a senior financial crime professional

Course Overview

This highly interactive, instructor-led and certified programme is designed to provide a practical, applied understanding of AML and financial crime risks, and how to design, implement, and lead an effective financial crime compliance framework. Developed by practising MLROs and industry experts, the course bridges the gap between theory and practice—equipping learners to confidently navigate the fast-evolving UK, EU, and international regulatory landscape.

Gain the latest insights into AML and financial crime typologies, predicate offences, sanctions evasion, and governance failures through real-world case studies and regulatory analysis. This course goes beyond awareness, focusing on how to apply that knowledge to build a robust AML framework, respond effectively to regulatory requests, and strengthen your firm’s financial crime governance structures.

Learners will be awarded the GCAL Advanced Financial Crime Compliance Risk Officer Certificate and the professional designation GC(AdvMLRO). You will also receive a verifiable digital badge, perfect for showcasing your certified achievement on LinkedIn—demonstrating your advanced capability in AML and financial crime compliance to peers, employers, and regulators.

DESIGNATION

Awarded in association with

Advanced AML Course Package

Course Details

Learning Outcomes

By the end of this AML Certified programme, learners will be able to:

- Clearly define the roles and regulatory responsibilities of the MLRO, Nominated Officer, Board, and Senior Management under UK Money Laundering Regulations and FCA expectations.

- Interpret and apply key international, UK and EU legal frameworks relevant to AML and financial crime risk management.

- Assess and respond to key predicate offences and financial crime threats, including fraud, sanctions evasion, terrorist financing, and bribery and corruption.

- Apply practical understanding of current criminal typologies and money laundering threat vectors by “thinking like a criminal”.

- Implement an effective framework of systems and controls through GCAL’s Seven Pillars of Success governance model.

- Analyse enforcement trends and global regulatory priorities to future-proof your financial crime programme.

- Benchmark your firm’s approach against industry standards, with the knowledge and tools to lead strategic AML and Financial Crime Compliance enhancements.

Who Should Attend

This certified programme is ideal for professionals looking to deepen their expertise and take a leading role in financial crime compliance, including:

- MLROs and Deputy MLROs responsible for firm-wide financial crime frameworks

- Nominated Officers and Heads of Financial Crime Compliance (FCC) seeking to enhance AML and FCC governance and oversight

- Senior Financial Crime or AML professionals overseeing AML, CTF, sanctions, fraud, and broader financial crime risks

- Internal Auditors and Assurance Professional evaluating the design and effectiveness of financial crime controls

- Aspiring AML or FCC Leaders preparing for senior roles such as MLRO, Deputy MLRO, or Head of Financial Crime Compliance

Delivery Format

All GCAL certified programmes are delivered online via an on-demand, instructor-led video format, with the flexibility to study at your own pace.

- Hosted via GCAL’s digital learning platform

- Interactive elements, including real-world case studies and scenario-based learning

- Clear learning journey with access to support materials, reading lists, and guided exercises

- Final assessment includes a 20-question multiple-choice exam

- Duration – 7–10 hours of learning time

Course Modules

This advanced-level certificate is structured around core themes essential to building, leading, and sustaining a robust AML and financial crime compliance programme. Key modules include:

- Introduction to Financial Crime Compliance

Establish a strong foundation with key definitions, objectives, and the evolving scope of financial crime risk management across regulated sectors. - Global Laws & Standards (UN, FATF, UK, EU, US)

Explore the international framework of AML and financial crime legislation, including the role of global standard-setters like FATF, and how national regulations intersect across jurisdictions. - “Think Like a Criminal” – Typologies and Threat Patterns

Understand current and emerging criminal methodologies. Learn how fraudsters, money launderers, and bad actors operate—and how to anticipate and counter their evolving strategies. - Predicate Offences and Associated Crimes

Deepen your knowledge of core offences including money laundering (ML), terrorist financing (TF), proliferation financing (PF), bribery and corruption, tax evasion, sanctions evasion, and human trafficking and modern slavery (HT/MS)—and understand how these risks impact firm-level compliance obligations. - Governance: Roles and Responsibilities

Define the statutory and regulatory responsibilities of key stakeholders including the Board, Senior Management Function (SMF) holders, the MLRO, and Nominated Officer—in alignment with UK Money Laundering Regulations and FCA expectations. - The Seven Pillars of Success Framework

Learn how to apply GCAL’s strategic compliance model covering:

- Risk Assessment

- Proportionate Policies and Procedures

- Tone from the Top and Senior Management Engagement

- Customer Due Diligence and Suspicious Activity Reporting

- Training and Communication

- Monitoring, Quality Assurance and Internal Audit

- Record Keeping and Engagement with Regulators

- Real-World Case Study Analysis

Apply your learning to real-life enforcement cases and regulatory events. Analyse where frameworks failed, what went wrong, and how similar risks can be identified and mitigated within your own firm. - Assessment

Demonstrate your understanding and readiness to lead by completing a structured self-assessment and a 20-question multiple-choice exam. Successful completion results in certification, a digital badge, and the award of the GC(AdvMLRO) designation.

Assessment

- Number of Questions: 20

- Question Format: Multiple Choice

- Pass Mark: 70%

Your result will appear immediately upon submitting your answers. If you meet the pass mark, a digital badge and e-certificate will be issued instantly via the GCAL LMS. You’ll also receive a secure link to share your certification on LinkedIn, with your employer, or across your professional network.

See our Assessment Terms & Conditions for more information.

Certification

Learners who successfully complete the course and assessment will receive:

- GCAL Advanced Financial Crime Compliance Risk Officer Certificate

- The post-nominal designation GC(AdvMLRO)

- A digital badge – shareable and verifiable via LinkedIn and other professional platforms

Pricing Options

We offer flexible pricing based on your professional development goals and the scale of your learning journey:

ENROLMENT

£800

Perfect for professionals looking to complete this certified programme and earn the GC(AdvMLRO) designation.

Advanced FCC AML Risk Officer Compliance Certificate

ADVANCED COURSES

£700 PER COURSE

If you’re planning to enrol in more than one GCAL Advanced Programme, enjoy a discounted rate when purchased together. Ideal for professionals building a broader skill set across AML, sanctions, fraud, and governance.

Browse All CoursesCOURSE PACKAGE

£3,000

Access all six GCAL Advanced Financial Crime Compliance programmes at a special bundle rate. Perfect for individuals or teams seeking comprehensive, cross-cutting training across key AML AND financial crime risk areas.

More InformationAll prices shown exclude VAT which will be added at checkout if applicable

LICENCES

Designed for organisations looking to roll out certified financial crime compliance training at scale. Packages include group enrolment, learner progress tracking, completion reporting, and dedicated admin support.

Contact us to discuss your enterprise training needs.

info@greatchatwellacademy.comContact FormReady to Enrol?

✔ Advance your AML and Financial Crime Compliance career

✔ Build leadership-level knowledge

✔ Join a trusted community of Financial Crime Compliance professionals

Buy Now or contact us at info@greatchatwellacademy.com to request an invoice or discuss group access.

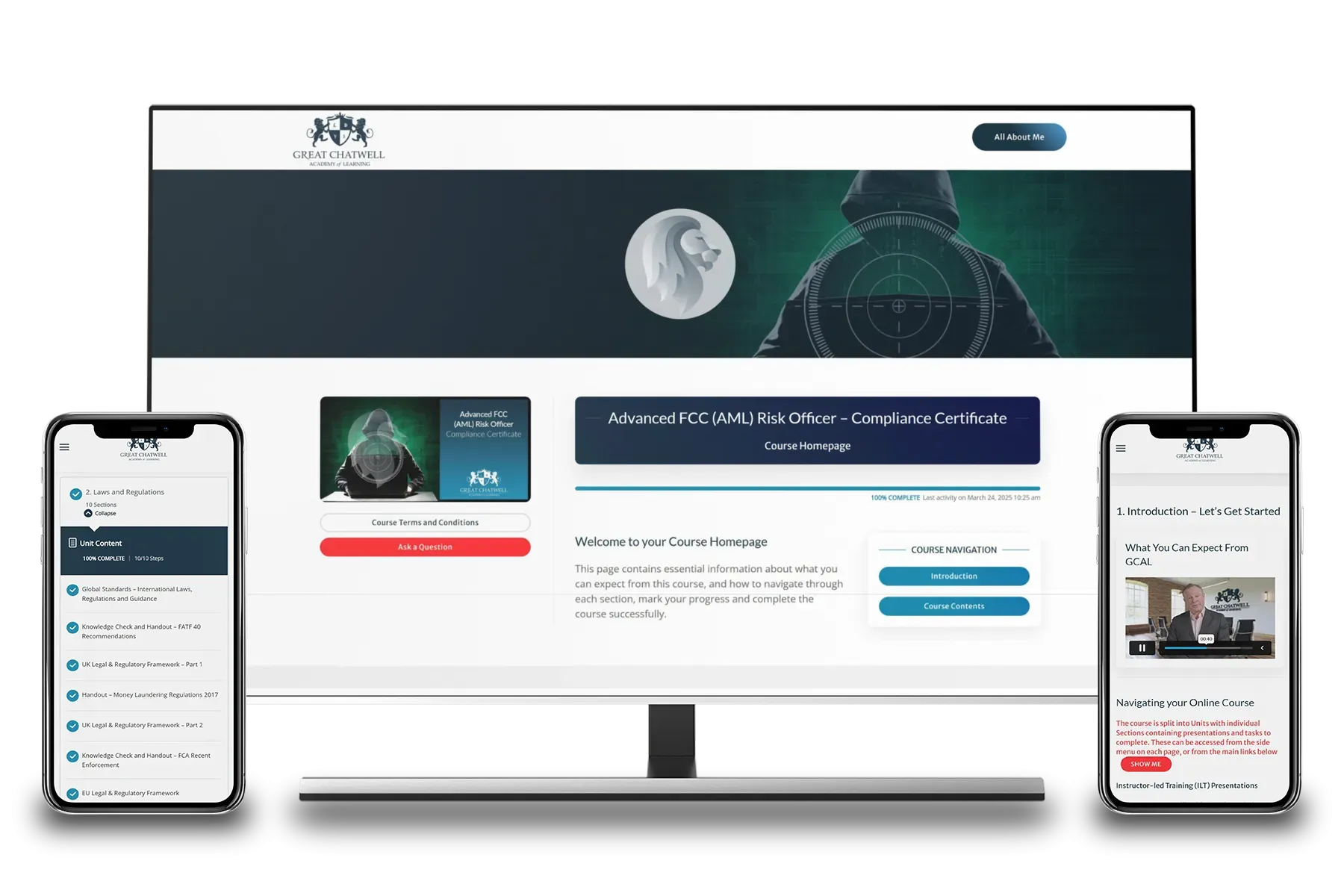

The GCAL LMS

Your Learning Management System

Experience the flexibility of on-demand AML and financial crime compliance training with our user-friendly GCAL Learning Management System (LMS). Designed for busy AML and Financial Crime compliance professionals, our platform allows you to access expert-instructor led courses and essential materials anytime, anywhere — on desktop, tablet, or mobile.

Auto-save functionality ensures your progress is always securely stored, so you can pick up right where you left off. With real-time progress tracking, empowering you to monitor your learning and stay engaged as you build the advanced skills needed to manage financial crime risk in a fast-changing regulatory landscape.