DIPLOMA IN FINANCIAL CRIME

The GCAL Financial Crime

and AML Compliance Diploma

Build the skills to think strategically, act decisively, and lead your firm’s approach to financial crime and AML compliance with confidence.

Diploma Overview

This flagship programme is designed to empower MLROs, DMLROs, and AML professionals with the strategic and operational skills required to deliver a meaningful impact in today’s complex financial crime landscape.

Split across five advanced-level programmes combined with a choice of three specialist skills development masterclasses, this self-paced qualification offers practical, work-based learning that can be applied immediately to your role.

The flexible structure allows you to tailor your development by selecting the masterclasses that best support your areas of focus and specialism – whether that’s strengthening governance, enhancing your personal communication and impact, or exploring specialist technial topics in more depth.

Upon successful completion of all modules, you will be awarded the GCAL Diploma in AML and Financial Crime, earning the GC-Dip(AML/FinCrime) designation — a mark of recognition of advanced, applied expertise, awarded in association with the University of Gloucestershire.

Requirements

PLUS, choose and complete three of the following online masterclasses.

Personal Performance: Communicating AML change and influencing others

Advanced AML Investigations: Using OSINT and EDD to Identify and Manage High-Risk Clients and PEPs

Business Wide Financial Crime Risk Assessment (BWRA): Practical Steps to Build a Compliant Control Framework

Cybercrime & AML: Managing Converging Threats in AML Compliance.

Diploma Details

Key Outcomes

You won’t just be informed of what the rules and regulations are — you’ll learn more about how to manage risk effectively, challenge assumptions, and implement effective and efficient systems and controls with confidence.

You’ll gain critical awareness of the AML operational landscape and the practical tools required to design an effective Financial Crime Compliance (FCC) framework. Learners are encouraged to apply their knowledge through interactive case studies, enhancing personal confidence and professional effectiveness.

Unlike static training programmes, this diploma-level programme is constantly evolving — informed by the latest regulatory developments, typologies, and enforcement trends. The instructor-led, interactive content is designed to help you to act decisively and think more strategically in the face of uncertainty and complexity in your day-to-day role.

Learning Format

This flexible, self-study programme is delivered entirely online via the GCAL Learning Management System. You will be invited to complete four advanced-level courses at your own pace, with access to expert-led content and interactive resources. In addition, participants join three online, instructor-led masterclasses focused on practical application and peer learning.

Upon completion of the full programme, you will be able to:

- Identify, analyse, and resolve complex financial crime and AML risks

- Develop and embed structured models and frameworks to manage your firms AML and financial crime risks

- Ask the right questions and challenge assumptions with confidence

- Interpret regulatory requirements and design proportionate, defensible controls

- Make sound, auditable decisions — and support others to do the same

- Align your firm’s financial crime governance with live enforcement notifications and current typologies

What’s Included

This advanced-level diploma is structured around a complete programme spanning financial crime compliance and AML risks essential to building, leading, and sustaining a robust AML and financial crime compliance programme.

Delegates will complete four Advanced Compliance Certificates chosen from the following:

- FCC AML Risk Officer – GC(AdvMLRO)

Gain a practical, strategic understanding of financial crime risk frameworks including AML, fraud, the financing of proliferation, and sanctions.

Explore typologies, predicate offences, and global laws through real-world case studies.

Apply the “Seven Pillars of Success” to build and assess the effectiveness of financial crime and AML controls. Perfect for MLROs, DMLRO, and those shaping firm-wide FCC strategy. - Suspicious Activity Reporting – GC(AdvSARs)

Report suspicion confidently and compliantly under the Proceeds Of Crime Act 2002, Terrorism Act 2000, and the Money Laundering Regulations 2017, and according to regulatory requirements.

Draft meaningful, intelligence-rich SARs and avoid tipping off.

Understand Nominated Officer duties and post-reporting controls.

Learn from real-life case law, regulatory actions, and NCA insights. - Firm-Wide Risk Assessment – GC(AdvFCR)

Master the design and execution of defensible FCRAs aligned to UK/EU/FCA standards.

Differentiate between inherent and residual risk using GCAL’s structured methodology.

Identify typologies and control effectiveness to inform board-level decisions. Move beyond templates to create tailored, data-driven financial crime risk assessments. - Customer Risk & CDD – GC(AdvCDD)

Implement risk-based CDD and EDD aligned with evolving legislation.

Use OSINT tools and digital ID techniques to verify identity and detect undisclosed risks and red flags.

Respond to the threat of high-risk structures like shell companies, nominees, and assess PEP relationships. Enables learners to develop effective onboarding, monitoring, and escalation processes. - Fraud Risk Management – GC(AdvFraud)

Stay ahead of evolving fraud typologies: APP, payroll, cyber, and insider threats.

Understand your duties under the new corporate criminal offence of “Failing to Prevent Fraud”.

Use structured fraud risk assessments and governance frameworks.

Develop effective preventative controls and apply case-led learning for real impact.

Delegates will also need to attend three online Masterclasses hosted by GCAL and guest presenters.

Choose from:

- Personal Performance: Communicating AML Change and Influencing Others

- Advanced AML Investigations: Using OSINT and EDD to Identify and Manage High-Risk Clients and PEPs

- Business Wide Financial Crime Risk Assessment (BWRA): Practical Steps to Build a Compliant Control Framework

- Cybercrime & AML: Managing Converging Threats in AML Compliance

Assessment

Assessment includes a multiple-choice exam at the end of each advanced course, and a 1,000-word reflective summary once you have completed all three masterclasses – demostrating what was learned, and how it benefits you and your firm.

Compliance Certificates

- Number of Questions: 20

- Question Format: Multiple Choice

- Pass Mark: 70%

Your result will appear immediately upon submitting your answers. If you meet the pass mark, a digital badge and e-certificate will be issued instantly via the GCAL LMS. You’ll also receive a secure link to share your certification on LinkedIn, with your employer, or across your professional network.

Certification

Learners who successfully complete the full diploma programme will receive the following in addition to the individual course accreditations:

- GCAL Financial Crime and AML Compliance Diploma

- The post-nominal designation GC-Dip(AML/FinCrime)

- A digital badge – shareable and verifiable via LinkedIn and other professional platforms

Enrolment

The fee for joining the Full Diploma Package is £3,000, including four advanced online certifications and to attend three Masterclasses, and the award of the GCAL Diploma in Financial Crime [GCDip( AML/FinCrime)], awarded in association with the University of Gloucestershire.

ACCESS

POA

To discuss a group enterprise programme for your firm, contact our team today.

All prices shown exclude VAT which will be added at checkout if applicable

LICENCES

Designed for organisations looking to roll out certified financial crime compliance training at scale. Packages include group enrolment, learner progress tracking, completion reporting, and dedicated admin support.

Contact us to discuss your enterprise training needs.

info@greatchatwellacademy.comContact FormReady to Enrol?

✔ Advance your AML and Financial Crime Compliance career

✔ Build leadership-level knowledge

✔ Join a trusted community of Financial Crime Compliance professionals

Buy Now or contact us at info@greatchatwellacademy.com to request an invoice or discuss group access.

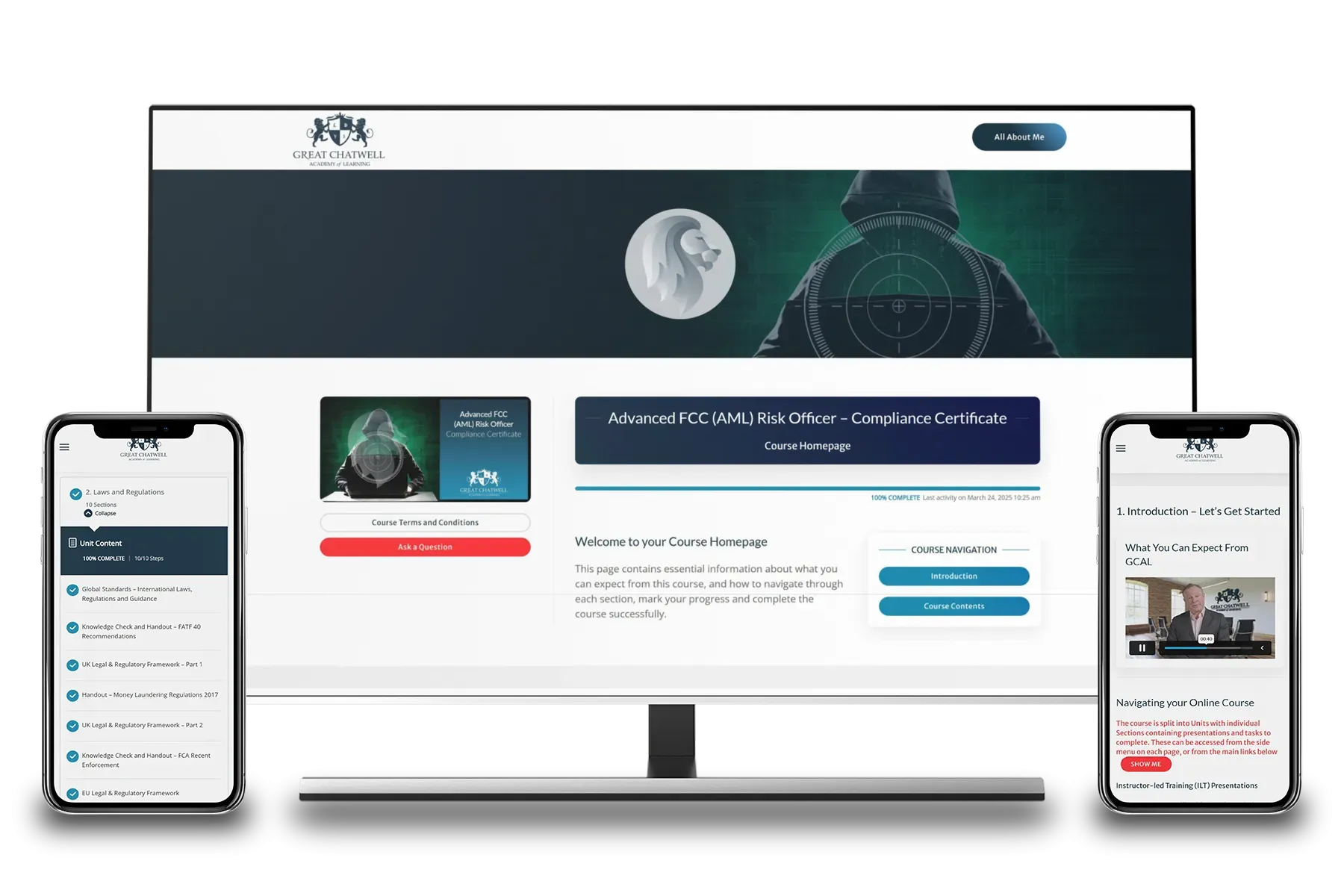

The GCAL LMS

Your Learning Management System

Experience the flexibility of on-demand AML and financial crime compliance training with our user-friendly GCAL Learning Management System (LMS). Designed for busy AML and Financial Crime compliance professionals, our platform allows you to access expert-instructor led courses and essential materials anytime, anywhere — on desktop, tablet, or mobile.

Auto-save functionality ensures your progress is always securely stored, so you can pick up right where you left off. With real-time progress tracking, empowering you to monitor your learning and stay engaged as you build the advanced skills needed to manage financial crime risk in a fast-changing regulatory landscape.