CERTIFIED ONLINE TRAINING

Fraud Risk Management

Compliance Certificate

A programme that is designed to provide the knowledge and guidance required to be a senior fraud risk professional

Course Overview

The GCAL Advanced Certificate in Fraud Risk Management Compliance is a certified, on-demand, instructor-led programme that provides the practical knowledge and tools needed to identify fraud threats, implement preventative controls, and meet the growing expectations of UK regulators. Learners will explore the latest fraud typologies, understand the profile of a fraudster, and examine how social engineering techniques are used to exploit firms, systems, and individuals.

Learners will examine UK legal frameworks including the Fraud Act 2006, Computer Misuse Act 1990, and the UK Economic Crime and Corporate Transparency Act 2023—featuring the new “Failure to Prevent Fraud” offence, which holds firms accountable if they benefit from fraud committed by employees.

Learners will examine a wide range of fraud typologies—including authorised push payment (APP) fraud, investment fraud, procurement and payroll fraud, identity theft, and cyber-enabled scams—supported by practical exercises and case-based scenarios.

With a strong focus on prevention and governance, the course introduces GCAL’s Six Pillars of Good Governance, helping learners implement effective fraud controls, conduct fraud risk assessments, use open-source intelligence (OSINT) tools, and have effective onboarding and verification controls including document verification technologies, and methods for raising consumer awareness around fraud and social engineering.

This certification is ideal for AML, Financial Crime and Fraud professionals looking to enhance their role in fraud detection, prevention, and compliance, while aligning with both legal and operational best practices.

Upon successful completion, learners are awarded the GCAL Advanced Certificate in Fraud Risk Management Compliance and the professional designation GC(AdvFraud) — a globally recognised credential demonstrating advanced expertise in customer risk assessment and due diligence practices. A verifiable digital badge is also awarded, making it easy to showcase your achievement on LinkedIn and share with employers, regulators, and peers.

DESIGNATION

Awarded in association with

Advanced AML Course Package

Course Details

Learning Outcomes

By the end of this AML Certified programme, learners will be able to:

- Describe the size, scale, and impact of fraud on individuals, organisations, and the wider economy, with a specific focus on common typologies such as Authorised Push Payment (APP) fraud, investment fraud, procurement fraud, identity fraud, and cyber-enabled scams.

- Define fraud under UK legal frameworks, including the Fraud Act 2006, Computer Misuse Act 1990, and the UK Economic Crime and Corporate Transparency Act 2023. Understand the government’s strategy to combat fraud, including Economic Crime Plan 2 (2023–2026) and new corporate liability under the “Failure to Prevent Fraud” offence, which comes into force on 1 September 2025.

- Conduct a fraud risk assessment using structured methodologies to evaluate internal and external fraud threats—spanning personal, corporate, financial, and non-financial risks. Apply scenario analysis and risk categorisation techniques to assess vulnerability across the business.

- Identify key preventative and detective controls to mitigate fraud risk, including customer and supplier onboarding checks, document verification tools, performance and transaction analytics, and strong governance using GCAL’s Six Pillars of Good Governance.

- Demonstrate the ability to recognise and investigate high-risk activity, including red flags, unusual behaviour patterns, and fraud indicators related to layering, document forgery, shell companies, or insider threats. Understand how social engineering plays a role in targeting staff, clients, and systems.

- Explain how to escalate and report suspected fraud, including internal protocols, whistleblowing channels, and making external reports to Action Fraud, the National Crime Agency (NCA), and via Suspicious Activity Reports (SARs) where appropriate.

Who Should Attend

This certified fraud risk management programme is ideal for AML professionals responsible for preventing, detecting, and responding to fraud across regulated sectors, including:

- MLROs and Deputy MLROs overseeing fraud reporting, investigations, and internal controls

- Fraud Prevention and Financial Crime Officers managing fraud risk assessments and customer or employee fraud prevention strategies

- Compliance and Risk Managers responsible for implementing anti-fraud frameworks aligned with legal and regulatory obligations

- Internal Auditors and Assurance Professionals reviewing the design and effectiveness of fraud controls and governance structures

- Onboarding, KYC, and Operations Teams involved in customer and supplier verification and identity fraud prevention

- Cybersecurity, IT, and Data Analysts supporting fraud monitoring, analytics, and incident detection

- Aspiring fraud and compliance professionals looking to build advanced capability in fraud risk, investigation, and escalation

This programme supports professionals looking to strengthen their firm’s anti-fraud framework, align with the latest UK legislation, and meet increasing regulatory expectations—especially in light of the new “Failure to Prevent Fraud” offence introduced under the UK Economic Crime and Corporate Transparency Act 2023.

Delivery Format

All GCAL certified programmes are delivered online via an on-demand, instructor-led video format, with the flexibility to study at your own pace.

- Hosted via GCAL’s digital learning platform

- Interactive elements, including real-world case studies and scenario-based learning

- Clear learning journey with access to support materials, reading lists, and guided exercises

- Final assessment includes a 20-question multiple-choice exam

- Duration – 7–10 hours of learning time

Course Modules

This certified programme is structured into the following modules, combining practical guidance, legal context, investigative tools, and real-world application. Each module helps learners build capability in identifying, preventing, and responding to fraud within regulated firms. Key modules include:

- Understanding the Fraud Landscape Explore the size, scale, and impact of fraud in the UK, including its effects on individuals, companies, and the public sector. Examine key fraud typologies such as Authorised Push Payment (APP) fraud, identity theft, payroll and procurement fraud, cyber-related scams, and investment fraud. Includes an interactive exercise on the profile of a fraudster and behavioural red flags.

- Legal and Regulatory Frameworks Understand the UK’s legal and regulatory obligations for fraud risk management. This includes the Fraud Act 2006, Computer Misuse Act 1990, UK Economic Crime and Corporate Transparency Act 2023 (including Companies House reform), and the upcoming “Failure to Prevent Fraud” offence (in force from 1 September 2025). Learn how the UK government is responding to fraud through Economic Crime Plan (2023–2026) and how these frameworks align with FCA expectations.

- The Role of Law Enforcement and External Reporting Gain clarity on the roles of national and international enforcement bodies, including Action Fraud, the NCA, London City Police, Europol, and Interpol. Learn how to escalate concerns, make Suspicious Activity Reports (SARs), and use formal whistleblowing procedures. Understand the role of the ICO in cases involving data misuse and disclosure.

- Governance, Strategy & Fraud Prevention Controls Apply GCAL’s Six Pillars of Good Governance to fraud prevention, including internal policies, senior management oversight, monitoring, and escalation. Learn how to build proportionate, risk-based controls for onboarding customers, employees, and suppliers. Explore practical methods such as clear desk policies, password protocols, and access controls.

- Risk Assessment & Fraud Categorisation Develop and conduct a fraud risk assessment using structured models that capture internal and external risks—personal vs corporate, financial vs non-financial, and online threats. Categorise fraud risks and align them with your firm’s appetite, control environment, and sector exposure.

- Detection Tools and Technology Explore techniques for detecting fraud through document verification tools, data and performance analytics, and open-source resources such as OSINT, TinEye, and other equivalent tools. Learn how to validate customer identities, flag suspicious documents, and identify behavioural red flags in real time.

- Case Study Application & Response Strategies Apply your learning through real-world case studies that highlight weak controls and effective responses. Cases include COVID loan fraud, payroll fraud enforcement, and a classic invoice scam. Learn how to escalate internally, report externally, support prosecution, and engage in asset restraint and recovery procedures.

Assessment

- Number of Questions: 20

- Question Format: Multiple Choice

- Pass Mark: 70%

Your result will appear immediately upon submitting your answers. If you meet the pass mark, a digital badge and e-certificate will be issued instantly via the GCAL LMS. You’ll also receive a secure link to share your certification on LinkedIn, with your employer, or across your professional network.

See our Assessment Terms & Conditions for more information.

Certification

Learners who successfully complete the course and assessment will receive:

- GCAL Advanced Suspicious GCAL Advanced Certificate in Fraud Risk Management Compliance

- The post-nominal designation GC(AdvFraud)

- A digital badge – shareable and verifiable via LinkedIn and other professional platforms

Pricing Options

We offer flexible pricing based on your professional development goals and the scale of your learning journey:

ENROLMENT

£800

Perfect for professionals looking to complete this certified programme and earn the GC(AdvFraud) designation.

Fraud Risk Management Compliance Certificate

ADVANCED COURSES

£700 PER COURSE

If you’re planning to enrol in more than one GCAL Advanced Programme, enjoy a discounted rate when purchased together. Ideal for professionals building a broader skill set across AML, sanctions, fraud, and governance.

Browse All CoursesCOURSE PACKAGE

£3,000

Access all six GCAL Advanced Financial Crime Compliance programmes at a special bundle rate. Perfect for individuals or teams seeking comprehensive, cross-cutting training across key AML AND financial crime risk areas.

More InformationAll prices shown exclude VAT which will be added at checkout if applicable

LICENCES

Designed for organisations looking to roll out certified financial crime compliance training at scale. Packages include group enrolment, learner progress tracking, completion reporting, and dedicated admin support.

Contact us to discuss your enterprise training needs.

info@greatchatwellacademy.comContact FormReady to Enrol?

✔ Advance your AML and Financial Crime Compliance career

✔ Build leadership-level knowledge

✔ Join a trusted community of Financial Crime Compliance professionals

Buy Now or contact us at info@greatchatwellacademy.com to request an invoice or discuss group access.

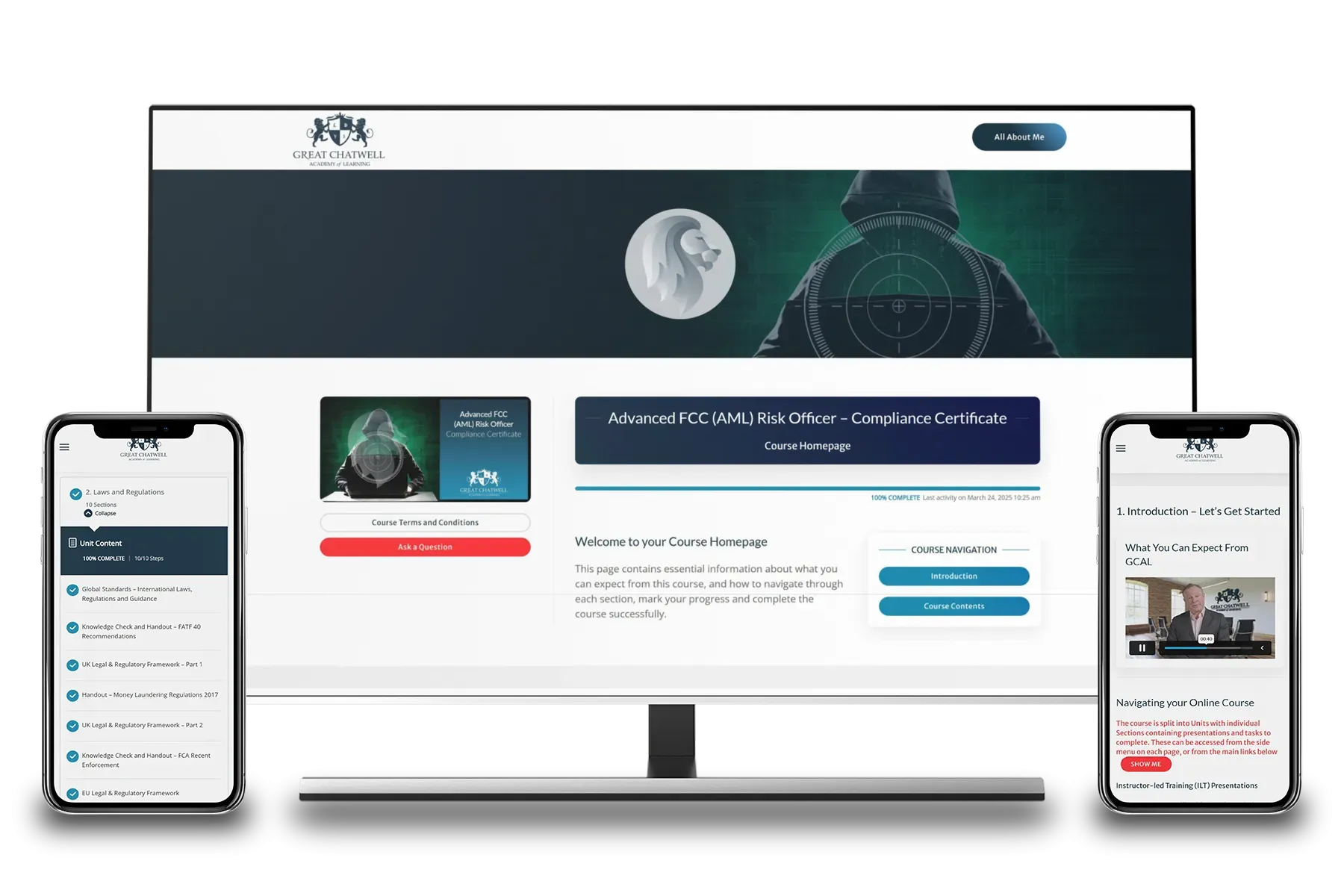

The GCAL LMS

Your Learning Management System

Experience the flexibility of on-demand AML and financial crime compliance training with our user-friendly GCAL Learning Management System (LMS). Designed for busy AML and Financial Crime compliance professionals, our platform allows you to access expert-instructor led courses and essential materials anytime, anywhere — on desktop, tablet, or mobile.

Auto-save functionality ensures your progress is always securely stored, so you can pick up right where you left off. With real-time progress tracking, empowering you to monitor your learning and stay engaged as you build the advanced skills needed to manage financial crime risk in a fast-changing regulatory landscape.